Your Property Assessment

Understanding Your Property Assessment

Property assessments reflect the market value of property as of July 1 (valuation date) of the year prior to taxation and the physical condition and characteristics of property as of December 31. Market value is the amount a property might be expected to realize if it sold on the open market.

How are property assessments prepared?

- Property Assessors inspect properties and collect, review and analyze information from three years of sales leading up the valuation date.

- An analysis of sale prices (as of the valuation date) is conducted against the assessments of similar properties to determine the assessment to sales ratio (ASR) of that property group. A ratio of 1.00, reflects accurate market value assessments.

- The final Assessment values are audited in two stages by the provincial government to ensure fair, quality and equitable assessments are prepared. The first stage is a review to ensure all ASR groups are within the acceptable provincial quality standards. The second stage includes a thorough review of processes undertaken by the property assessor during the preparation of property assessment values.

What factors influence the assessed value of a property?

Factors that typically influence assessed property values include:

- The location, quality, size, features and age of a home

- Renovations and additions to a home

- Influences on a property, such as but not limited to view, greenspace and traffic

How do property assessments affect property taxes?

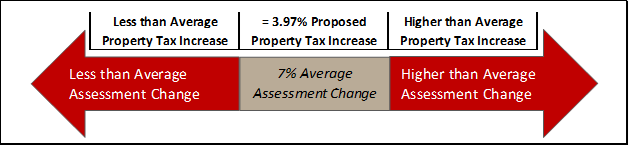

Properties that experience a change in assessed value less than the average change of that property class (i.e. residential) will see a lower-than-average change to their property tax, while properties that experience a change in assessed value above the average of a property class will see a higher-than-average change to their property tax.

Properties which experience a change in assessed value equal to the average change to its property type would see a municipal property tax bill similar to the previous year plus any budget adjustments imposed by City Council.

Citizens won’t know the exact impact of their assessments on their property tax bill until late May. This is when the municipal property tax rate is finalized by City Council and the City receives the education and seniors requisitions from the Provincial government and Bridges Community Foundation.

Example: The Residential assessment class property values increased by an average of 7%. A single-family home that experienced a year-over-year increase in assessed value of approximately 7%, would see the municipal portion of property tax increase from 2025 by the amount of the proposed property tax increase (3.97%).

Timelines

The City of Red Deer's assessment and tax timeline is as follows:

- January 08, 2026: property assessment notices mailed

- January 08, 2026: Staff available to respond to questions about your property assessment

- March 17, 2026: Property assessment appeals must be received by the clerk of the Assessment Review Board

- May: Council sets the tax rates

- Late May: Property tax bills mailed

- End of June: Property tax payments are due on the last business day

NOTE: Due to the processing delay at the Province of Alberta Land Titles Office, recent ownership and mailing address changes may not be reflected on Assessment Notices.

Property Tax Exemption

Applications for non-profit organizations for property tax exemptions are accepted on an annual basis.

Supplementary Assessment and Tax

Supplementary assessment reflects the increase in value of a property during the current tax year. Supplementary tax is the amount of tax levied on the supplementary assessment only.

Understanding My Property Assessment Notice

Need help understanding your property assessment notice? View an interactive sample.

Map of Assessed Values

You can use the Assessed Value map in Web Map to compare the assessed value of your property with others in your neighbourhood or throughout the city.

Property Inspections

City of Red Deer property assessors do property inspections for information required to complete the annual assessment.

Residential Request for Information

To meet the Provincial Government audit guidelines, and to assist in calculating fair valuation of all property, the assessment office must update recorded property characteristics at least once every five years.

Non-Residential Request for Information

As part of our commitment to ensuring the highest degree of accuracy for our annual assessments, we conduct ongoing market research which includes tenant/occupancy status of individual properties and the details relating to such.

Change of Mailing Address

Have you recently moved? It is your responsibility to notify us.

Section 299-300 Assessment Information Request

As a property owner, you are entitled to see or receive sufficient information about your property and a summary of any assessment in accordance with sections 299 and 300 of the Municipal Government Act.

Contact Us

Revenue & Assessment Services

403-342-8235

assessment@reddeer.ca

For residential square footage information, email assessment@reddeer.ca