How is Supplementary Tax Calculated

What is supplementary assessment?

Supplementary assessment reflects the increase in value of a property during the current tax year. This occurs where new construction is completed or occupied during the current tax year. A Supplementary assessment is also calculated when a major renovation or addition is completed on an existing home or building.

Here are two examples of how The City of Red Deer calculates supplementary tax on residential property:

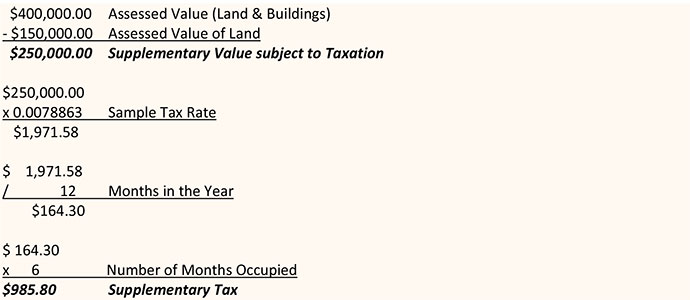

Example 1

A vacant lot is assessed at $150,000 as of December 31. In the following year, construction of a home starts in March and is completed and occupied as of July 1. The property is assessed at a total value of $400,000 which consists of the land assessed at $150,000 and the building at $250,000. The annual tax notice – sent in May – is based on the value of the vacant land. The supplementary tax notice is calculated as follows:

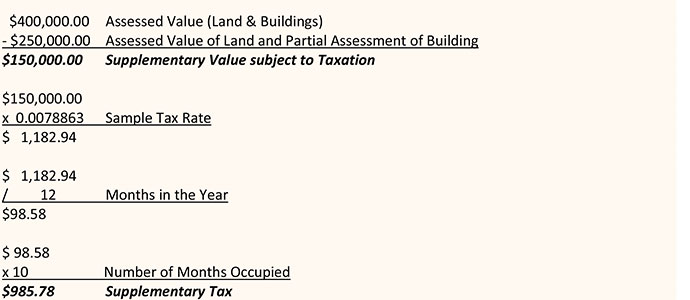

Example 2

A property with a partially constructed home is assessed at $250,000 as of December 31. In the following year construction is finished and the home is occupied as of March 1. The property is assessed at a total value of $400,000. The annual tax notice – sent in May – is based on the partial assessment of $250,000 (that includes the land and value of the partially constructed home). The supplementary tax notice is calculated as follows:

If you would like more information about supplementary assessment and tax, please email the Assessment Department.